Best Crypto Portfolio Tracker for Privacy-Focused Users

Cryptocurrency has graduated far beyond mere spot trading. Investors in 2025 balance portfolios consisting of exchange accounts, decentralized wallets, positions in all later farmings offering yields, and yes, tokenized traditional assets as well. Managing it all needs a lot more than a spreadsheet – a dashboard that can impose order upon chaos.

From Dispersed Tools to Centralized Dashboards

In the beginning, investors had to use a combination of spreadsheets, balance pages on exchanges, and standalone DeFi trackers. This was fragmented more often than not: the balances didn’t reconciled, the ROI was calculated differently every time, and investors spent a lot of time trying to reconcile several views. Then came modern dashboards that fixed this issue by aggregating multiple data streams in a single-clear picture.

Example: A holder of assets on Binance, DeFi protocols on Ethereum, NFTs on a wallet on Metamask can now access it all on a single dashboard. Something that previously necessitated use of three different tools now auto-refreshes in real time.

Why 2025 will be the competition year of platforms

Dashes by 2025 have become the de-facto entry point for crypto investors. Almost every major exchange and standalone service provides one, though they do so differently. Some focus on minimalism as a gateway for occasional investors. Others cater to professionals as a means to provide advanced analytics as tax reporting as auto-processing. It’s tough competition since dashes can no longer be value-adds as a nicety but mandatory infrastructural requirements.

“The portfolio dashboard in 2025 won’t be a nicety; it will be the headquarters for the serious crypto investment guy.”

What Constitutes the “Best” Dashboard Nowadays

Selecting the correct dashboard in 2025 is no longer a matter of aesthetics but rather a matter of credibility, richness, as well as ease of use. Investors measure standards by how much they can simplify things yet not conceal pertinent information. Four factors dictate if a dashboard can be labeled “the best.”

Portfolio Metrics Precision (ROI, PnL, cost basis)

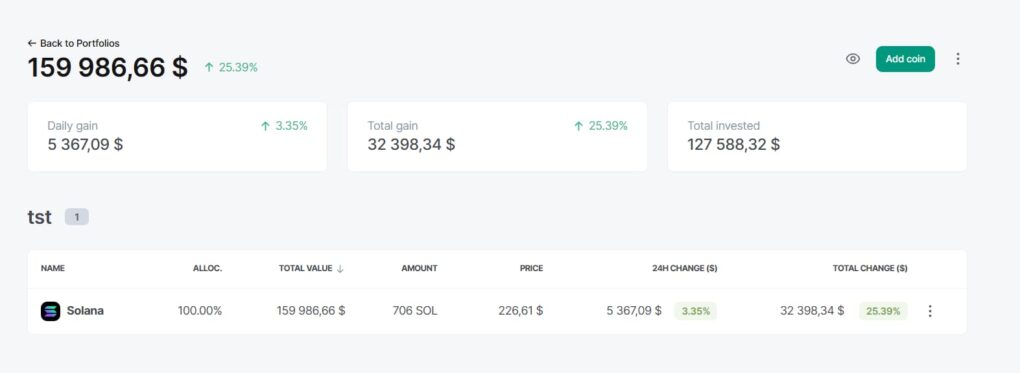

To any investor, though, the first thing that matters is if numbers can be trusted. ROI, PnL, and cost basis need to reconcile to reality. Even minor inaccuracies strip away confidence. Dashboards that fetch data directly from exchanges, DeFi protocols, and wallets immediately provide the best reconciliations.

Case example: When a staking reward on Solana doesn’t appear for several hours later on, the whole performance viewing feels unbalanced. Platforms where these subtleties get handled perfectly make a big difference.

Breadth of integrations (CEX, DeFi, NFT)

Contemporary portfolios span several asset classes. A healthy dashboard insulates not just central exchanges but DeFi pools, NFT positions, and now more often than not, tokenized equities or bank-connected assets. Investors desire a single location where they can see complete net worth in total, not a trio of independent apps.

Table: Investor Expected Types of Integrations (2025)

| Integration type | Why it matters |

| Centralized exchanges | Ultimate source of liquidity and spot trading |

| DeFi protocols | Yield farming, staking, lending transparency |

| NFT wallets | Collectible tracking and digital assets tracking |

| Internet links | Tokenized equities, blended finance portfolios |

Interface usability and learning curve

Even with powerful features, adoption will fail if the interface overpowers. The top dashboards provide complexity in layers: a simple overview for occasional glances and advanced modules for in-depth exploration. A simple layout lowers the learning curve and maintains users over the long-haul.

Security, Resilience, and Privacy

Investors also consider how a dashboard safeguards their data. Non-custodial protocols, read-only APIs, and transparency in encryption methods are now minimally acceptable expectations. Uptime and fault tolerance also count: when volatility runs hot, system down will not do. Dashboards that keep fully functional under pressure receive more credibility.

“A dashboard is not mere feature-itis. It’s precise, usable, and something that instills confidence that it will not break when markets turn.”

Top in 2025

With dozens upon dozens of rival dashboards in existence in 2025, the question no longer becomes if investors require one, but instead, which service truly offers the correct amount of features. Following are summaries of the top-ranking platforms beginning with CoinDataFlow.

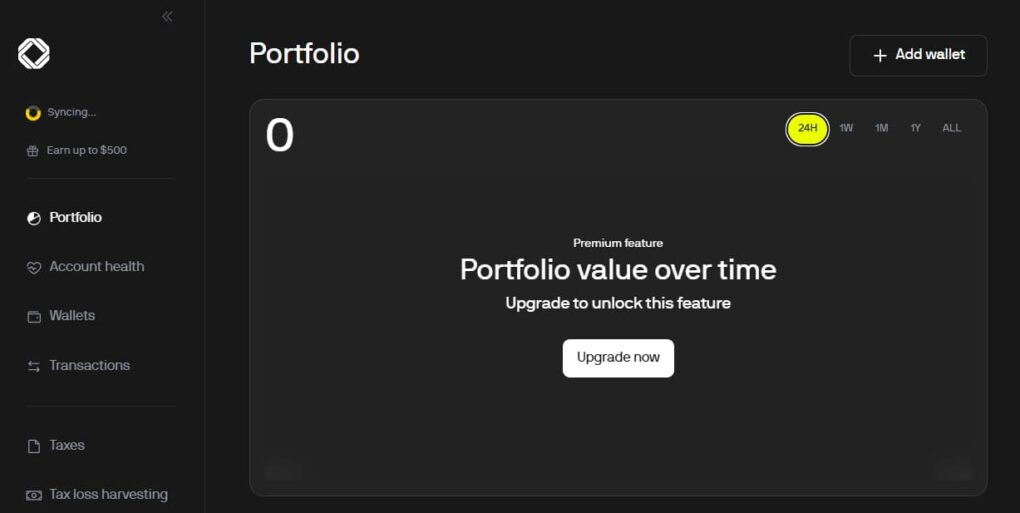

1. CoinDataFlow

https://coindataflow.com/en/portfolio-tracker

CoinDataFlow has earned a reputation as an independent, neutral tracker that strikes a balance between simplicity and depth. It offers transparency for newcomers while providing experts with the tools they anticipate.

Market-wide integration and non-biased portfolio perception

Differing from exchange dashboards that are affiliated with a particular venue, CoinDataFlow compiles the data on several exchanges, wallets, and chains. This autonomy enables investors to view their net worth without bias, avoiding blind spots typical in exchange-native tools.

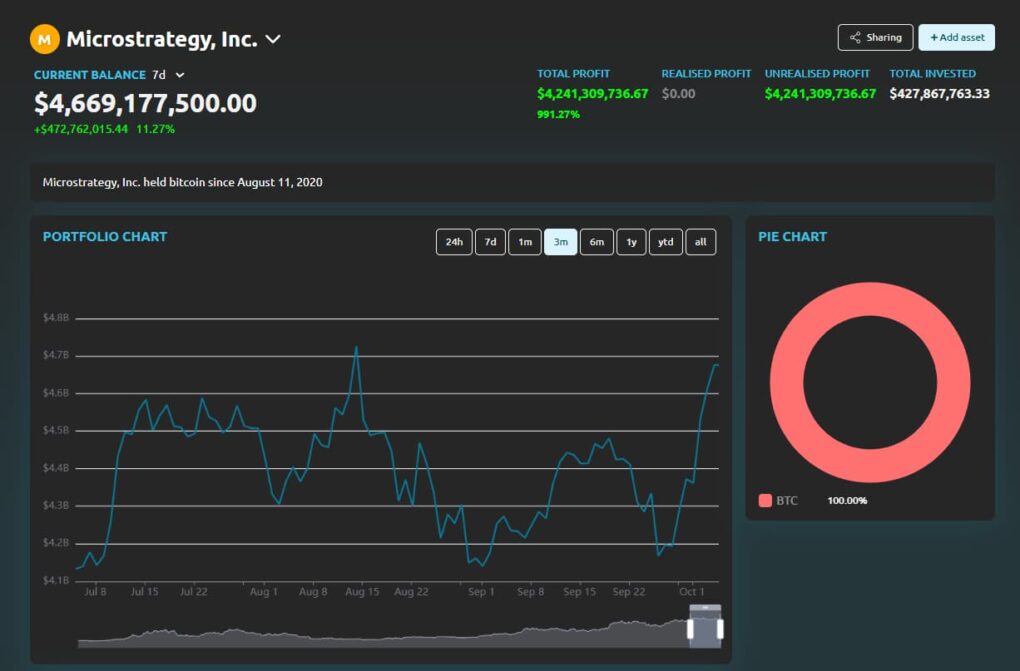

Robust ROI/PnL analytics and transparency

Precise PnL and ROI reporting is CoinDataFlow’s strongest aspect. It updates in real time for staking rewards, DeFi positions, and NFTs. This accuracy makes it simpler for both traders and long-term holders to measure performance with confidence.

Balanced simplicity and depth

The interface finds a rare equilibrium. Beginners get a clear snapshot, while experts can access advanced analytics, exports, and tax-ready reports. Some advanced options require subscriptions, yet compared to competitors, the learning curve remains soft.

Table: CoinDataFlow Overview (2025)

| Feature | Strength | Consideration |

| Integrations | ✅ Comprehensive coverage (CEX, DeFi, NFTs) | ❌ API setup mandatory |

| ROI/PnL accuracy | ✅ Real-time and detailed | ❌ Some history locked in premium |

| Interface design | ✅ Simple but strong | ❌ Extra modules for pros |

| Audience | ✅ Newcomers + experts | ❌ Casual users may not require full depth |

2. Coinexplorers

https://coinexplorers.com/portfolio

Coinexplorers appeals to minimalists who crave simplicity first. It frames itself as a free, lightweight tracker but not a complete professional dashboard.

Minimalist design and free access

The biggest benefit of Coinexplorers is its bare-bones interface. Investors can rapidly link wallets or paste public addresses to check balances. For beginners or users who don’t require tax tools, it offers a free and quick way to monitor holdings.

Breakdowns in tax instruments and sophisticated metrics

Its simplicity comes at the expense of depth. ROI and PnL reporting is minimal compared to competitors that support cost basis, staking income, or advanced trades. It also doesn’t offer compliance features, making it frustrating for investors preparing audits or tax filings.

Table: Coinexplorers Overview (2025)

| Feature | Strength | Limitation |

| Cost | ✅ Free access | ❌ Professional features scarce |

| Interface design | ✅ Simple and clean | ❌ Limited customization |

| ROI/PnL reporting | ✅ Elementary tracking | ❌ Weak cost basis & tax handling |

| Audience | ✅ Casuals, beginners | ❌ Not suitable for advanced users |

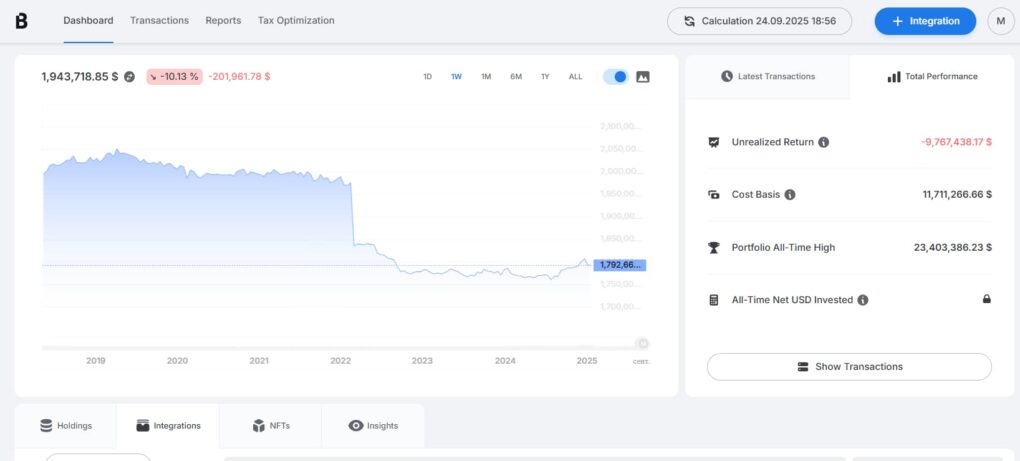

3. Blockpit

Blockpit positions itself as a portfolio tracker with a robust compliance foundation. It’s designed for investors who want tax reporting built directly into their dashboard instead of being treated as an afterthought.

Automation strengths in tax compliance

One of Blockpit’s standout advantages is its automation in creating jurisdiction-specific tax reports. It can access native tax protocols in multiple countries, saving investors hours of manual work. This makes it especially valuable for those who actively trade across various exchanges and require precise declarations.

Limitations in interface and real-time analytics

Despite its strength in compliance, Blockpit’s interface is less polished compared to design-oriented competitors. The dashboard can be overwhelming for casual users, and its real-time ROI/PnL tracking isn’t as sharp as rivals. Many investors end up using Blockpit for taxes while relying on another app for daily monitoring.

Table: Blockpit in 2025

| Feature | Strength | Limitation |

| Tax tools | ✅ Automated, per-country | ❌ Steeper learning curve |

| ROI/PnL tracking | ✅ Decent but not best-in-class | ❌ Missing fine-grained real-time data |

| Interface design | ✅ Functional for professionals | ❌ Less friendly for beginners |

| Audience | ✅ Tax-focused investors, pros | ❌ Not suitable for casual holders |

“Blockpit erases the compliance headache but often doesn’t meet the requirements of everyday portfolio tracking.”

4. CoinTracker

CoinTracker has established its reputation as a hybrid between a portfolio dashboard and a tax solution. It’s widely favored by investors due to its extensive integrations and recognition among accountants.

Popular for tax integrations

CoinTracker connects with a broad range of exchanges and wallets, automatically generating cost basis and tax forms across multiple jurisdictions. For U.S. investors, it’s especially valuable since it integrates directly with TurboTax and similar tools, making compliance easier during tax season.

Complexity and subscription fees

The drawbacks are twofold: the platform can be confusing for beginners, and its best features are locked behind premium plans. The free version only covers a limited number of trades, which quickly becomes insufficient for active traders. Combined with occasional lag in DeFi integration, many users eventually look elsewhere once their activity grows.

Table: CoinTracker in 2025

| Feature | Strength | Limitation |

| Tax tools | ✅ Direct integrations with software | ❌ Premium price for full access |

| Integrations | ✅ Broad CEX + wallet coverage | ❌ DeFi and NFT support still weak |

| ROI/PnL reporting | ✅ Strong historical records | ❌ Free plan very restrictive |

| Audience | ✅ Tax-focused traders & investors | ❌ Beginners may find it confusing |

💡 Example use case: An investor with multiple exchange accounts finds CoinTracker invaluable during tax season but prefers another tracker for daily ROI/PnL monitoring.

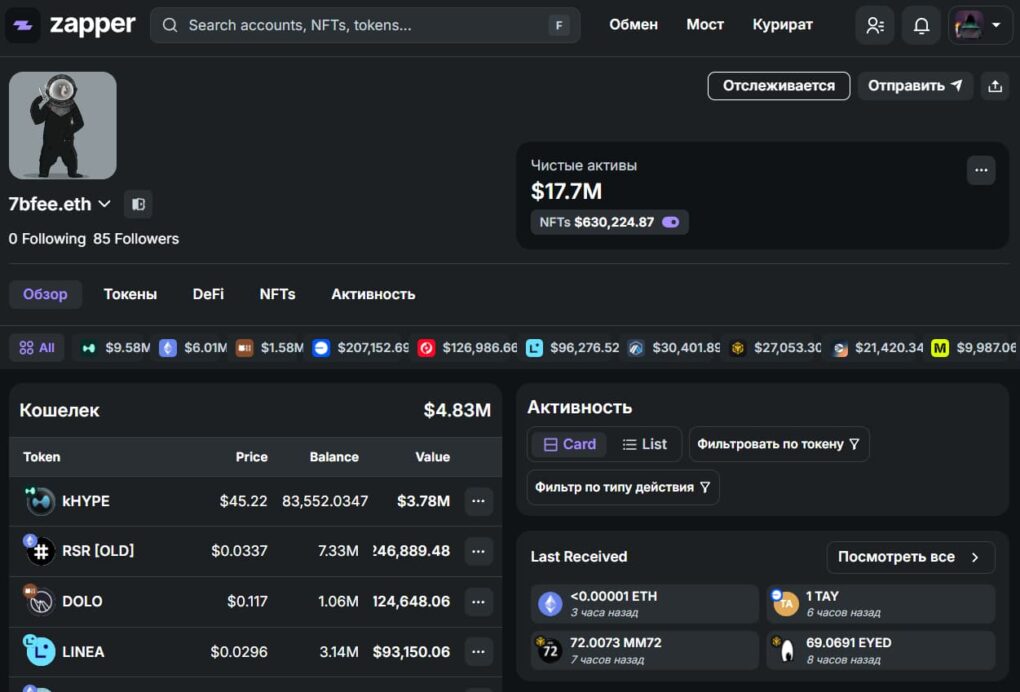

5. Zapper

Zapper carved its niche as one of the most recognizable dashboards for DeFi and NFT investors. Its aesthetic design and wallet-centered setup make it especially appealing to users who engage daily with decentralized protocols.

DeFi and NFT-centered dashboards

The platform thrives at consolidating intricate DeFi positions – liquidity pools, staking, yield farming – all in a single page. It also offers robust NFT gallery capabilities, letting investors track both their portfolio value and collectibles without needing multiple apps. For crypto-native users, this setup feels natural and complete.

Gaps in centralized exchange tracking

The downside is its limited CEX integration. Zapper focuses heavily on blockchain-native activity, leaving investors who depend on Binance, Coinbase, or Kraken with partially incomplete dashboards. While it delivers strong visuals, those who want a unified overview of all assets often need to pair Zapper with another tool.

Table: Zapper in 2025

| Feature | Strength | Limitation |

| DeFi coverage | ✅ Broad LP, staking, farming integration | ❌ Restricted centralized exchange data |

| NFT support | ✅ Inbuilt gallery and valuations | ❌ Not useful for non-NFT users |

| Interface design | ✅ Sleek and modern | ❌ Can feel busy for simple needs |

| Audience | ✅ DeFi/NFT-focused investors | ❌ Not ideal for mixed portfolios |

📌 Case example: An investor with 80% of their holdings in Ethereum DeFi finds Zapper perfect, but someone splitting assets between CEX and DeFi may struggle with its incomplete coverage.

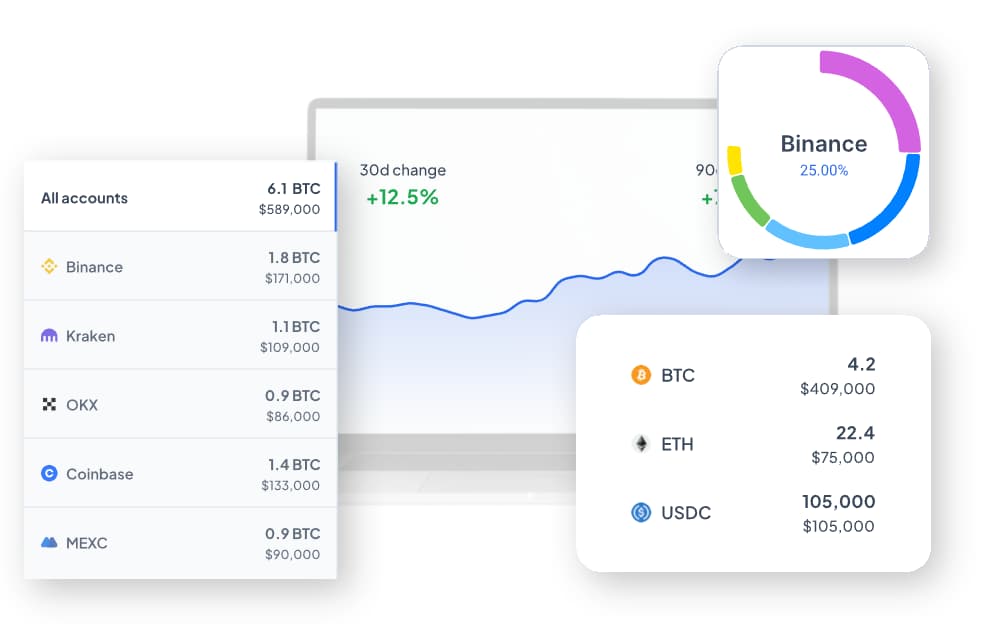

6. Altrady

https://www.altrady.com/features/crypto-portfolio

Altrady appeals to professional traders who juggle multiple exchanges and accounts at the same time. Its roots are in providing professional-level trading terminals, and this legacy still shapes both its strengths and weaknesses today.

Active trading tools

It integrates natively with leading centralized exchanges, offering advanced charting, live alerts, and portfolio summaries tied directly to trading activity. Features like “smart trading” (automated stop-loss, take-profit, and scaling orders) reduce manual effort for heavy users such as day traders. This gives Altrady an advantage for those trading daily and needing immediate execution.

Not easy on casual investors

However, its depth of features makes Altrady less appealing to average portfolio holders. The dashboard can feel cluttered, with trading-heavy controls overshadowing simple portfolio views. Subscription prices are also higher compared to lightweight apps, discouraging casual users.

Table: Altrady in 2025

| Feature | Strength | Limitation |

| Exchange integrations | ✅ Strong for major CEXs | ❌ Not very relevant for DeFi/NFT investors |

| Trading tools | ✅ Advanced orders, real-time alerts | ❌ Overwhelming for beginners |

| Pricing | ✅ Good value for active traders | ❌ High cost for casual users |

| Target audience | ✅ Day traders, semi-professionals | ❌ Not suitable for passive holders |

📌 Example: A day trader managing accounts on Binance and KuCoin may find Altrady indispensable, while a long-term investor holding ETH and BTC in cold wallets would hardly need most of its features.

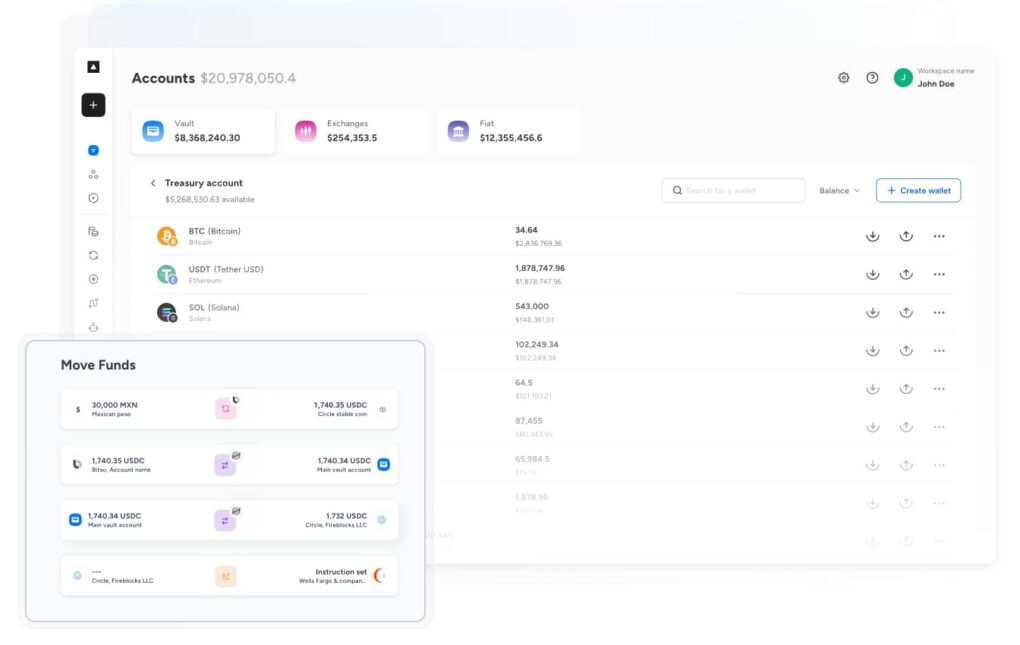

7. Fireblocks

Fireblocks is a very different type of dashboard, aimed directly at institutions and enterprises rather than everyday crypto holders. Its main focus is on custody, compliance, and secure transfer infrastructure, which makes it highly respected in professional finance but impractical for small investors.

Enterprise-level custody and compliance

The platform equips banks, funds, and large trading companies with tools to protect digital assets using enterprise-grade encryption, multi-party computation (MPC) wallets, and institutional-level transaction approvals. It also integrates compliance layers such as AML tracking and audit trails, making it ideal for regulated environments where oversight and security are non-negotiable.

Not applicable for retail users

The drawbacks are straightforward: pricing, complexity, and a heavy institutional focus make it unsuitable for casual traders or hobby investors. A regular user managing a $10,000 portfolio would find Fireblocks not just overkill but nearly inaccessible, since onboarding is designed for firms with compliance departments and IT staff.

Table: Fireblocks in 2025

| Feature | Strength | Limitation |

| Custody | ✅ MPC wallets, institutional security | ❌ Not needed for retail portfolios |

| Compliance | ✅ AML, KYC, audit integration | ❌ Too complex for individual users |

| Pricing | ✅ Scales for enterprises | ❌ Prohibitively costly for retail |

| Audience | ✅ Funds, banks, custodians | ❌ Not intended for casual traders |

📌 Case in point: A hedge fund operating across multiple jurisdictions might rely on Fireblocks for compliance and transaction infrastructure, while an individual investor would find it far beyond their needs.

What the Comparison Indicates

After reviewing the main dashboards of 2025, certain patterns emerge that highlight how the market has matured and where gaps still exist. Each solution follows its own philosophy, yet they share some strengths while also repeating familiar weaknesses.

Common strengths across dashboards

Most interfaces now meet a reliable standard when calculating ROI and PnL. API links with major exchanges, wallet integrations, and blockchain scanning have made errors far less common than in the early years. Even free platforms such as Coinexplorers or well-known names like CoinMarketCap Portfolio provide trustworthy balance updates. Security expectations have also risen, with two-factor authentication, encryption, and clear permission management becoming the norm.

Table: Shared strengths (2025)

| Aspect | Observation |

| ROI/PnL accuracy | Uniform across nearly all reviewed platforms |

| API & wallet coverage | Most connect to top exchanges and major blockchains |

| Security basics | 2FA, encryption, transparency in keys widely adopted |

| UX maturity | Interfaces generally clearer than in 2020–2022 |

Persistent weak spots in the market

At the same time, weaknesses are equally evident. Tax and compliance tools remain uneven: some platforms (e.g., Blockpit, Koinly, TaxBit) invest heavily, while others barely offer reporting exports. Usability is another problem area – advanced dashboards like CoinTracking or 3Commas overwhelm beginners with cluttered layouts. Meanwhile, pricing models have become more aggressive, pushing casual investors back toward free but shallow alternatives.

📌 Example: A semi-professional trader juggling both DeFi and CEX positions often ends up paying for multiple services, since one platform cannot yet fully handle both.

Why some solutions feel more balanced

In this environment, the most practical dashboards are those that strike a balance between usability and professional-grade metrics. Platforms that lean too far toward simplicity or overload users with institutional-grade features tend to miss the sweet spot. Solutions like CoinDataFlow naturally stand out because they blend clarity, automation, and broad integrations without making daily usage unnecessarily complex. They avoid forcing users to choose between accessibility and depth – a balance many competitors still struggle to achieve.

FAQ

Here are the most frequent questions investors ask in 2025 when choosing a crypto dashboard. Answers range from short explanations to detailed ones with examples.

Which dashboard is best for new crypto investors?

Simple tools with easy interfaces and minimal setup are best for beginners. Services like CoinMarketCap Portfolio or MetaTracker provide clean overviews without complex API setup. As portfolios expand, investors often move toward feature-rich dashboards that deliver accurate ROI/PnL tracking and multi-wallet support.

Do I require a premium tool for advanced portfolio management?

Yes. Once trading volumes exceed just a few exchanges, premium dashboards become necessary. They provide advanced analytics, tax integration, and compliance tools that free platforms almost never match. For anyone managing six-figure amounts or handling both DeFi and centralized exchanges, premium tools quickly prove their value.

Can I track DeFi and NFTs alongside exchanges?

Many dashboards now support DeFi and NFTs, though coverage varies greatly. Zapper and DeBank excel in decentralized visibility, while CoinDataFlow and Zerion combine centralized and decentralized holdings. Still, NFT valuations are not always displayed consistently, and DeFi metrics can lag.

How risky is connecting APIs to dashboards?

Most dashboards encrypt API keys and allow fine-grained permissions, reducing risks. The safest practice, however, is limiting withdrawal rights when creating exchange keys. Independent dashboards such as CoinDataFlow or Accointing emphasize non-custodial setups, meaning they never hold funds – only read balances.

What distinguishes the leaders from the rest in 2025?

Top dashboards combine:

- Accurate ROI/PnL aligned with real-time market data.

- Broad integrations (CEX, DeFi, NFTs, sometimes banks).

- User-friendly dashboards fit for both beginners and active traders.Security and privacy transparency, with non-custodial design.

- Tax readiness, ensuring painless year-end reporting.

These are the traits that increasingly determine whether a dashboard feels like a professional tool or just a side project.

Conclusion

The portfolio dashboard landscape in 2025 shows both maturity and fragmentation. On one hand, nearly every leading solution now provides baseline accuracy, wallet connectivity, and essential security. On the other, investors still face a choice between platforms that are either too simplistic or overly institutional.

For retail traders and semi-professionals, the biggest challenge is balance: handling crypto, DeFi, and even traditional assets without subscribing to three different services or navigating interfaces built for hedge funds. Dashboards that merge simplicity with integrations and automation – while staying accessible – naturally stand out.

Competitors like CoinMarketCap Portfolio, Zapper, or Fireblocks highlight the diversity of the market, from casual tracking to enterprise-level custody. Yet, the most appealing tools are those that combine the best of both worlds, aligning with the everyday realities of 2025 investors.

The future of portfolio tracking is not about trendy features or narrow niches. It’s about trustworthy dashboards that simplify complex portfolios and make them actionable. Platforms that achieve this balance are likely to lead the next phase of adoption – and investors, more than ever, are ready to choose tools that streamline without compromise.