New Introductions and Tools for Business Strategy Update

Conference Program

New Approaches to Budgeting for Companies in the Face of Frequent Pandemics Around the World

For small companies, budgeting is one of the most critical

Read MoreRead More

The Importance of Unit-Economy in Online Gambling

Several well-known companies are excellent examples of businesses with strong

Read MoreRead More

Personal Loans: Understanding Your Options at the Financial Conference

Everyone can encounter financial challenges at any moment, and it

Read MoreRead More

How to build a control system of budget preparation

The main purpose of making any plans is to develop

Read MoreRead More

The motivation system on which new businesses take off and companies with a history are reborn

The growth of productivity in Japan outstrips the growth of

Read MoreRead More

Unit-economy: a tool to accurately forecast online sales

Is your business profitable? Well, it could be. You invested

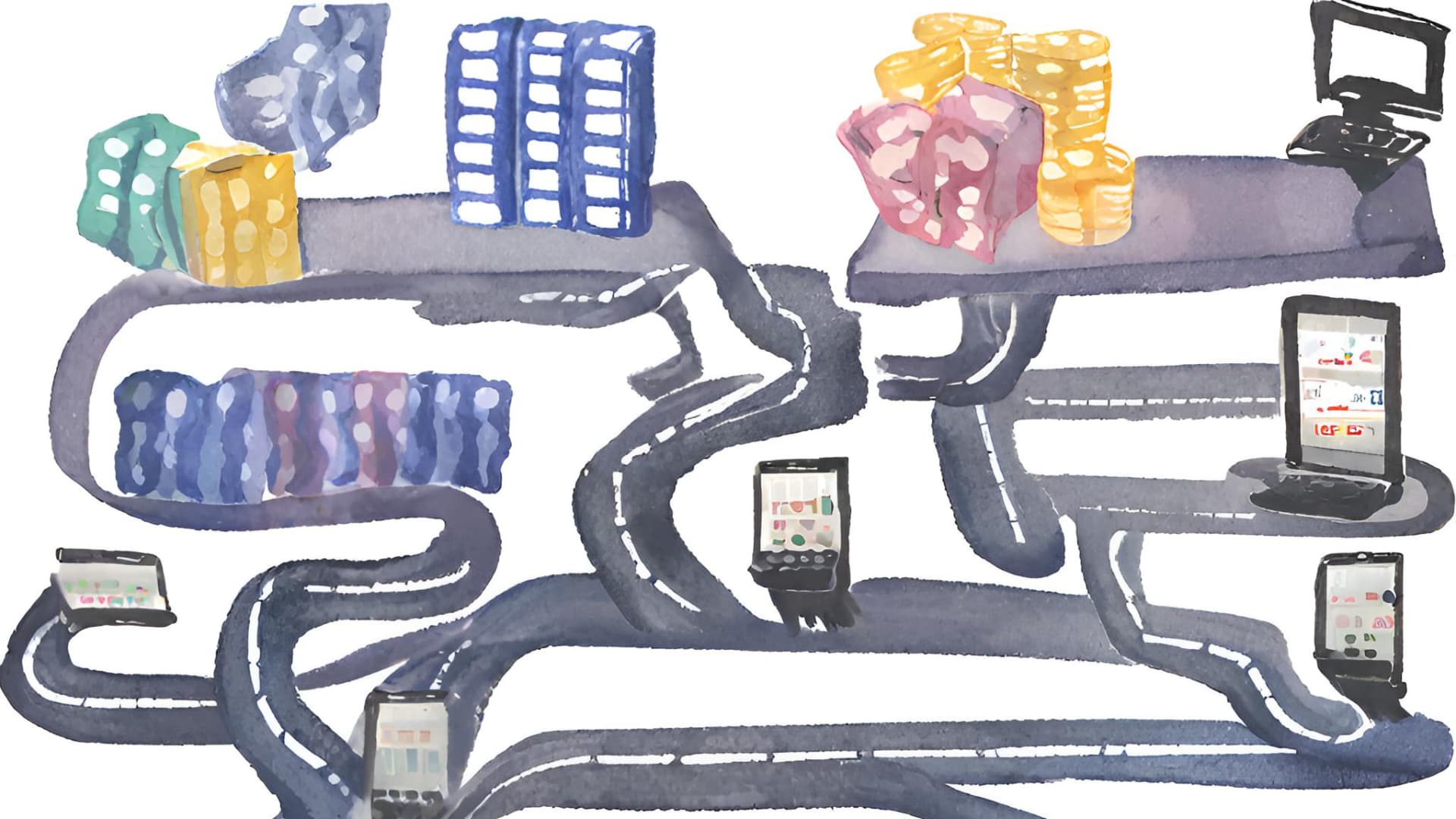

Read MoreRead MoreThe digital transformation of business is changing the requirements for analytical data, for the speed of obtaining information, and hence for the budgeting system as well. The best cases of corporate budgeting in modern conditions will be presented at our conference in September.

Modernize your budgeting process together with the best domestic and international companies!

“Wonderful opportunity to hear stories about the experience of budgeting in companies of different sizes and different industries.”

Clifton Altenwerth, CFO

“Very interesting event. Very informative, varied, multi-faceted. Ability to see different options and experiences in solving the same problems. Excellent organization of the event. Thank you!”

Isaac McClure, deputy head of the Office of Economic Control

“Very good level of organization. It manages to gather the right set of ideas to kick-start development within ourselves. Thanks for the development”

Nicholas Hessel , Project Manager

Partners

Learn the latest ways how to buy bitcoin in Canada

We are working on a project about the cryptocurrency market in Poland and the use of online casino payments among Poles. This project is carried out at the request of the TopKasynoOnline.com project and its owner – Milan Rabszski. Very soon, we will jointly release our research to the public, so please wait.

Cryptocurrencies are very volatile tool. You have to be carefull when bying or selling them on exchanges. Visit dodge coin price prediction to understand what to expect from dogecoin in 2023, 2024, 2025.

Gamblers receive a unique gaming experience with a focus on local preferences and payment methods in Canada, New Zealand, India and Australia. 1Go Casino is an ideal platform for those looking to play in a safe and secure environment.

Full list of bitcoin online casinos available for users from Germany

Finding a reliable and safe non Gamstop casino can be very difficult, especially in the UK with the UKGC and Gamstop overseeing everything. The guys at NonGamstopCasinos.net have found a way to help you!

Bonza Spins is truly a top Australian gambling platform. That’s why you’ll find top iGaming providers and, of course, top bonuses as well. Do you think 150 free spins is worthy of your attention? Then how about a welcome bonus of up to $800? Stop pondering and join in and see what other surprises await you.

InstantCashTime.com – our company helps people receive payday loans onlne more than 20 years. You can get fast cash advance at Instant Cash Advance. It doesn’t matter what your credit history you have, we will always help you by providing money from 200 to $ 5,000 same day.

For questions about conference participation, speaking opportunities, and sponsorship, please call +1-912-588-9519 or email [email protected]